Nowadays, insurance is becoming more crucial than ever as the “protection gap” – the disparity between the economic and social benefits provided by the insurance coverage for individuals, families, and businesses, and the actual amount of insurance purchased – is widening.

1. Protection Gap:

According to the Swiss Re Institute, from 2000 to 2020, the protection gap doubled due to global trends in digitization, urbanization, climate change, and insufficient innovation.Solely considering private pension coverage, the Geneva Association, an international consultancy organization, estimates the global protection gap to be $20 trillion USD. This means that most people won’t have enough financial support to live comfortably in their old age. The COVID-19 pandemic has further highlighted and exacerbated this situation.

2. Retirement Savings Shortfall (Trillions USD):

Given the significant protection gap, one might think it presents a golden opportunity for the insurance industry. However, according to McKinsey, 80% of insurance companies were unprofitable or had negligible profits in the years leading up to the COVID-19 pandemic, and the outlook suggests it could get worse. The fundamental weakness lies in the insurance business model – an inability to efficiently match supply with demand.On the demand side, insurance products are often complex, inflexible, expensive, prone to mis-selling, and cumbersome (with numerous forms to fill out). The benefits for customers are uncertain and distant. On the supply side, distribution costs (selling products to customers) are significant, accounting for about 50% of total costs. Insurance companies are risk management experts, but their underwriting staff lacks real-time data to create affordable and personalized products that keep up with market needs, trends, and emerging risks.Regulations designed for the pre-digital age further restrict them. Many have rejected health insurance due to lower costs at “basic” clinics compared to the amount spent on insurance. Considering the 1.7 billion people without access to banking services or nearly 50% of the world’s population living on less than $6 per day, insurance issues become truly “lost.”The big question here is how the insurance industry can rethink its business model and provide more significant value to the market, benefiting all stakeholders: individuals, families, companies, partners, governments, and investors, across all corners of the globe.

3. Embedded Insurance – A New Trend:

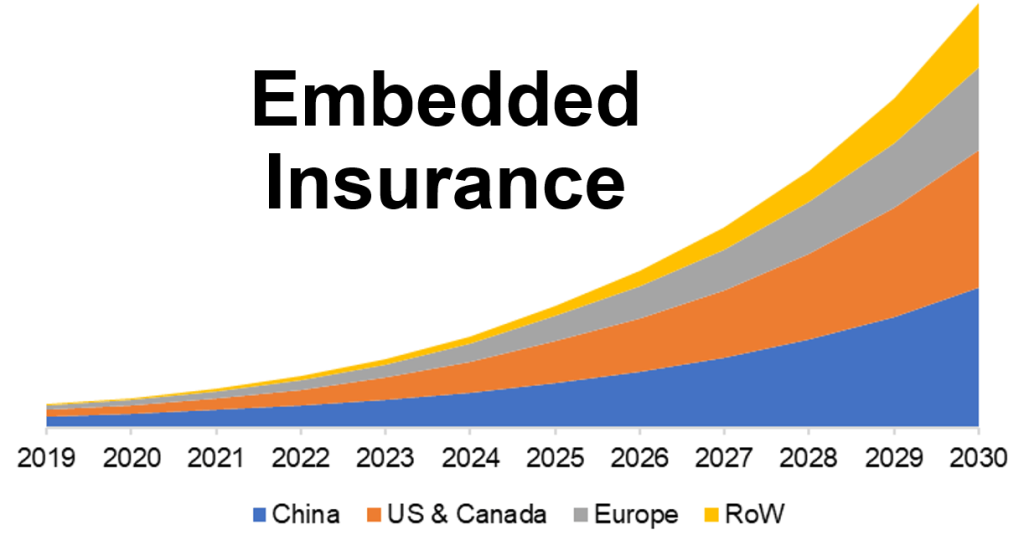

Embedded insurance is emerging as a new way to distribute insurance services efficiently. While it doesn’t address the protection gap directly, it tackles many supply and demand issues and can act as a catalyst to transform the business model on a broader scale.It’s part of a larger trend towards embedded finance, going beyond current approaches to distribution and partnerships. This trend is powered by APIs, modular software, and artificial intelligence (AI), as well as the rise of innovative intermediaries.Specifically, embedded insurance involves abstracting insurance functions into technology to allow any product or service provider or third-party developer in any field to seamlessly integrate innovative insurance solutions into their propositions and customer experiences, either as complementary utilities to their core services or as entirely new core components.For end-users, individuals, or businesses, this means simpler and more affordable solutions at touchpoints and the most convenient times. For third parties, it signifies a new way to differentiate, attract or retain users, or create new revenue streams.Similarly, in India, where only 3% of the population has insurance, major digital platforms like Amazon and Paytm are starting to introduce affordable protection solutions to the market.Another significant player, Uber, with its extensive online presence and a global network of 3 million drivers, illustrates the need for flexibility in providing various insurance types tailored to its drivers’ needs. Uber’s vast driver pool presents an opportunity to offer more complex products such as pensions, life insurance, and future health coverage alongside other financial services like banking and loans that Uber has provided. In any case, Uber takes pride in the simplicity of the user experience and demands insurance solutions that are easy to apply, provide good value, and handle complaints quickly.The challenge is that traditional insurance companies have struggled to meet the demand for flexible products suitable for Uber’s dynamic environment and related to new insurance portfolios. Drivers are not “employees,” Uber doesn’t own a “fleet of vehicles,” drivers don’t want “yearly insurance,” and any “dead” time results in lost income. Thus, like other digital organizations, Uber is increasingly collaborating with various new insurance companies, such as managing general agents (MGAs) and others, providing more easily embeddable solutions into their driver experience. In the UK, digital insurance provider INSHUR allows Uber drivers to apply for insurance with optional terms through a mobile app in just 3 minutes.As more online business activities emerge, smaller retailers and marginally profitable product manufacturers are seeking ways to provide additional services such as theft and damage protection at the point of sale. These services need to be adaptable to customer requirements, cost-effective, and flexible. For some retailers, these supplementary support services could account for up to 50% of their net profit.In the past, due to technical and contractual complexities when dealing with traditional providers, only the largest retailers and merchants had the capability to integrate such extended warranties, and only on high-value items. However, Amazon found that offering warranties – even on a $40 backpack – increased their purchase rate. New insurtech intermediaries are helping any online seller to provide similar services more easily and cost-effectively.Business-to-business (B2B) “software as a service” companies like Square, Intuit, Gusto, Xero, and Toast provide management systems for small businesses in various industries. With their real-time knowledge of their customers’ financial status, they are in an excellent position to integrate personalized insurance solutions into a range of other financial services they provide. This generates additional substantial revenue with almost no customer acquisition costs.”Embedded insurance” is a tool to bring supply and demand for risk mitigation solutions closer together in contexts that make insurance more relevant and therefore more appealing.While retailers, manufacturers, airlines, banks, professional associations have been distributors of insurance products for a long time, embedded insurance has the potential to elevate this to a different level.BIMA is an excellent example of bringing affordable health insurance into the mobile ecosystem, closing the protection gap for 35 million people in Africa today. A crucial metric for them is that 75% of these customers are accessing insurance for the first time.One of BIMA’s customers in Ghana shares: “I have a very large family and couldn’t work due to a leg injury. As a construction worker, I barely make enough money and owe creditors 1,200 GHS. I applied for compensation and received 1,800 GHS. I am very grateful.”No traditional insurance company can predict the specific needs of countless suitable requests, and testing will not be cost-effective. However, those closer to the customer can do so thanks to new technology.Technology is advancing and subsequently allowing the reconfiguration of the insurance value chain. The boom of insurtech companies is creating better versions of the “industry group” factors previously only provided by first-tier insurance companies. Investment in this innovation reached a new high of $2.3 billion USD with five IPOs in Q3 2020.

4. Digitization and Fragmentation of the Insurance Market:

As seen in banking, payments, and other tightly managed industries, service segments can be unbundled from the system and provided to the embedded insurance market. To understand the impact of this modularization and how it may unfold, let’s examine how the market operates today and the developmental trends.Traditionally, most insurance is sold through agents, brokers, and, in some markets, by banks and their common third-party partners, using phones, face-to-face methods, and many paper processes. Online aggregator tools are becoming popular in some markets by optimizing discovery processes and price transparency.Insurance products and their distribution are generally managed by first-tier insurance companies or multinational companies like Axa and Allianz through their operations in their respective countries or domestic companies. Insurance companies and many insurtech companies also sell directly to consumers (D2C), bypassing broker commissions but incurring significant sales costs. For example, today’s distribution of P&C insurance is summarized in the diagram below. Although there is quite a significant difference in these areas and between individual P&C product types, it might be noticed that, overall, embedded insurance fully (as defined in this report) currently holds a very small share, about 2% globally today and even less in life and health insurance.

Filling the Void: Exploring Insurance Gaps and Emerging Trends in Embedded Insurance Solutions.

Navigating Uncovered Risks: Understanding Insurance Gaps and the Rise of Embedded Insurance Trends.

Closing the Gaps: Embedded Insurance Trends Addressing Unmet Needs in Today’s Market Landscape.

This insightful piece delves into the emerging trends of insurance gaps and embedded insurance, highlighting their impact on the evolving insurance landscape.

With a focus on addressing gaps in coverage and integrating insurance into everyday transactions, the article sheds light on innovative approaches shaping the future of insurance.